Well, I am always looking for some good theme to write on. Have not written much off late on Personal Finance and Mutual Funds. Of course, I am only, at the most, a mutual fund enthusiast, who knows a bit more than many ill-informed or semi-informed people out there.

One school of thought believes that NFOs (New Fund Offers) are useless bets. When you have so many existing schemes, why to go for a new scheme. While you have some historical data points and qualitative information (for example, the profile of the fund manager) to judge an existing scheme, not much is available on NFOs. The only thing you have is A BEAUTIFUL SALES PITCH. I also happen to belong to this school of thought (a thorough loyalist, even the same applies to IPOs, but we will talk about it later sometime).

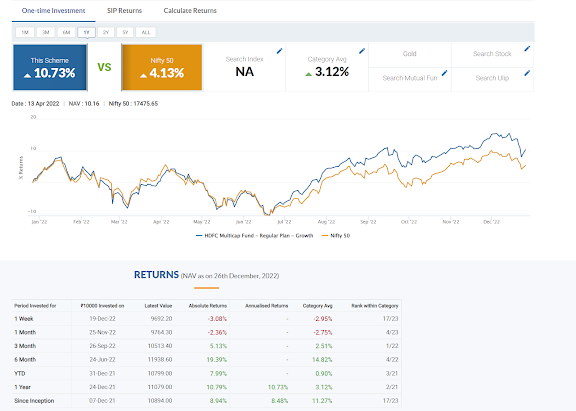

Let us start with the data of one recent NFO of HDFC Multicap Fund, derived from moneycontrol on 27 Dec, 2022. While the figures are not much legible, the graph clearly shows that the fund has beaten its benchmark index (a so called alpha) by a very high margin in one year. Though one year cannot be considered enough to judge a mutual fund's scheme, the performance of HDFC Multicap Fund is highly appreciable so far.

Data.....data speaks....data cries,....data yells....just listen.....

But this much data is not enough to justify the hypothesis that not all the NFOs are good or bad. So, let us take some more data points.

Here is one more piece of data that shows us the most successful NFOs of (2021) in terms of collection of rupees (highest AUM)

Source:

Top 7 Mutual Fund NFOs of 2021 | Value Research (valueresearchonline.com)

The data clearly shows that except SBI Balanced Advantage Fund, not any other fund has shown any miraculous performance, in terms of generating alpha (beating the benchmark) or in terms of beating the category average. Plus, because these funds are too fresh, there is no way to evaluate or know how they had handled the downsides in the previous economic cycles. The performance of the fund, thus, remains a mystery.

Even the performance of HDFC Multipcap is also not too inspiring in the above data. Though its performance on Dec 27, 2022 has improved much. But still, not enough time has passed to know if it will be able to sustain this performance during the different market cycles.

Let us delve further into the data. Let us take example of ICICI Pru Flexi-Cap NFO.

Well, in its short term of existence, it seems to have done well. But if you see at rating, it says, "unrated". Because people at valueresearch (the ET uses its data for MF section) know very well that an NFO cannot be rated 5 star or 1 star, simply in one year's performance.

Here is some more data on short term performance of NFOs:

Data as on Nov 12, 2019

This article clearly states that while some NFOs might have done well in short run, their long term performance is always in question. They are like question marks of BCG. So, when you already have stars in the BCG category (old mutual funds with a proven track record), why should you buy the NFO?

Well, there are many reasons why people buy (or are made to buy) NFOs:

1. High Expense Ratio: SEBI rules clearly state that as the AUM of a mutual fund increases, its expense ration must reduce. This means that NFOs are a good way to charge more to the customers and make good quick bucks.

2. Selling something "New": Every NFO comes up with a promise of a newness. A new theme, a new way of investment. It is like every NFO is a new potential multibeggar! People generally buy in the sales pitch of the fund houses and invest in NFOs.

3. Low NAV!: Some people buy NFOs because they are available at cheap NAV! Wow! Wow! Wow! is all I have to say! A Rs. 10 NAV is better than Rs. 209 NAV per unit! I mean, come on boss. Every mutual fund invests in certain shares at current market price. So, low or high NAV cannot be compared to a stock, which is a value buy. Your returns of a mutual fund simply depends on the returns that are generated out of its portfolio. The NAV is simply a number, that does not tell you anything about its performance. Read the following two articles to know how NAV is calculated and why it is a useless number for a serious investor!

So, my overall understanding, that NFOs are "generally" a useless product for a typical retail investor is not so wrong.

Buy an NFO, only and only if:

1. It adds true diversification to your existing portfolio.

2. You understand its investment hypothesis, its pros and cons, risks very well and feel that there is enough compelling case to invest in that NFO.

3. Generally, there are enough existing funds available in the market in each category to choose from, whose performance data is easily available.

Please note that I am merely a Mutual Fund enthusiast and the conclusion drawn above are merely based on very selective pieces of data. Investment is a complex process and there are many competing theories at play. Comments and feedback are welcome. pvariya@gmail.com