Active Vs Passive Mutual Funds: Concepts, Pros and Cons and Place in the Portfolio

[A] Introduction: There has always been a debate whether active style of investment is better or passive. In other words, should one invest in a typically actively managed mutual funds, or should one go for ETFs? Both the sides have their arguments and the arguments of both the sides are quite valid. Let us explore the issue further and conclude, which one is better - active or passive!

[B] What is an actively managed mutual fund?: In simple terms, when a mutual fund's portfolio is designed by a fund manager, assisted by a team of researchers, it is called an actively managed fund. Such mutual funds' main aim is to beat their benchmark index (like Sensex of Nifty50) and generate so called "alpha". The proponents of this style of investment argue that investment is all about stock picking. And one can generate alpha by picking up the right shares. That, the market does offer "opportunities" for discovering under valued share (i.e. value investing) or a share with high price, but still a very good potential to grow in the long run, where the price does not matter (i.e. growth investing).

Such funds' managers keep changing the portfolio at certain intervals, based on their research, changing macro indicators, and other business environmental variables.

Many fund categories are actively managed in India. For example, flexicap, ELSS, Multicap, Small Cap, Mid Cap, Focused funds etc.

Generally, such funds do well, where the markets are not fully developed (or are developing). Where a lot of research is still to be done on most of the shares (i.e. the small cap shares in the Indian market) for the purpose of so called "price discovery".

But, as the markets become grown (like USA market), most of the shares are well researched. There is no way to find a share, which is undervalued.

So, many investors turn to the passive investment in such markets as actively managed funds have very high expense ratio, in the form of salary of the fund manager, the cost of research etc.

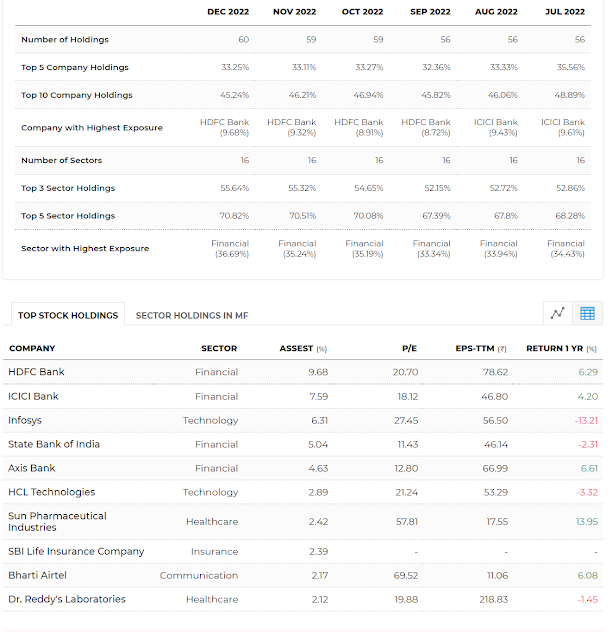

For example, here is the today's holdings of DSP Tax Saver Fund

As you can see, in July 2022, ICICI Bank was the share with the highest exposure. But come Dec 2022 and HDFC Bank became the share with the highest exposure.

[C] Passively Managed Mutual Funds: Compared to the actively managed mutual funds, passively managed funds like Equity Traded Fund or Fund of Fund (FoF) that invests in a passively managed fund. In India, we prefer to call such funds as "Index Funds" too. Such funds simply mirror the holdings of an index like Nifty50. For example, if you compare holdings of a typical index fund like UTI Nifty50 Index Fund, you will realise that it holds the same companies, in the same proportions, as per the Nifty50.

So, whenever, Nifty50's shares are changed, the fund manager of this scheme, will equally change the same shares, in the same proportions. He will not apply his mind here.

Thus, passive investing is nothing but a simple 'copy paste' of the index's portfolio.

The main benefit of passive funds is that their expense ratio is very less. Plus, their returns do not depend upon the judgments of the fund manager.

But the same thing will prevent these funds from generating very high returns. They will generate high returns only and only when the market (the index) generates the high returns.

At the same time, the actively managed schemes can generate extremely good returns if the call of the fund manger goes right. Should his call go wrong, these schemes can really damage your portfolio. Plus, these schemes' expense ration is generally very high, compared to the passive ones.

[D] Which one should you go for?: It depends. Both the styles have their pros and cons. MY OPINION (CAN BE WRONG AS WELL) is that, in a country like India, where majority of the listed shares are in small cap segment, actively managed funds, if the fund manager is good along with the research team and processes, can do wonders. It also depends a bit on the category.

Most of the recent data shows that, as far as LARGE CAP FUNDS are concerned, they have not been able to beet the Index funds like UTI Nifty50 Index funds, in the long run. Yet, they charge high expense ratio.

Plus, as the market grows further, they (large cap fund) will find it very difficult to generate alpha as most of the large cap shares are thoroughly well researched.

So, all in all, MY OPINION is that one can consider investing in passive mutual funds that mirror Sensex or Nifty50, in place of large cap funds.

But, there are enough opportunities left in other segments, particularly in mid and small caps, for one, to invest in the actively managed funds.

Of course, at the end of day, everyone's strategy and views are different. Everyone has different risk tolerance profile. So, make a choice, based on your own research or research of your advisor.

I would also say that holding both types of funds also give you a kind of diversification, in terms of style of investment.

Happy Investing!